What Are Double Bottom Patterns? W Pattern Trading Explained

However, if you are already at the annual allowance for your ISA, then a General Investment Account might be more attractive. Persons” are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United States. The industry’s best pricing. Use profiles to select personalised content. And like we briefly mentioned earlier – you don’t necessarily have to choose one of these styles over the other. Firstrade scored well for penny stock trading in our 2024 Annual Awards, and is a great choice for Chinese speaking investors. They may claim their programs can let you know when to make trades. The options market is very difficult to comprehend, especially for novice traders. 27 BKC, C 27, G Block, Bandra Kurla Complex, Bandra E, Mumbai 400051. If you also like playing color prediction games, visit this website. Monday Friday, 9 AM to 5 PM EST. We use cookies from Adobe and AppDynamics to collect information for these purposes. Insurance doesn’t apply to cryptocurrency, so if your exchange fails, you could lose your investment. Share Market Holiday 2024.

“M” AND “W” PATTERNS

You can also refer to Plus500’s free Economic Calendar feature which lists some of the most important market events. Here the trader sells a call but also buys the stock underlying the option, 100 shares for each call sold. They aren’t in the business of giving you advice or suggesting stock picks. For example, they might choose to buy and sell in price increments of $0. The Nifty stock index chart has exhibited positive divergence as indicated by orange lines. Here’s how to make your podcast stand out from the rest. Trading involves risk and can result in the loss of your investment. Use profiles to select personalised content. These margin rates may not be applicable to all assets. Help is needed so I can start investing again. The advantage of using market orders is that you’re guaranteed to get the trade filled; in fact, it will be executed as soon as possible. In this example, we measure the widest part of the triangle and apply it to our breakout in order to set our 1st target zone. In the USD/JPY pair, you are buying the US dollar by selling the Japanese yen. NerdWallet’s best brokers https://pocket-option.click/ru/ for options. However, the 13 period EMA has to be below the 50 period EMA or cross below it. Please do not share your personal or financial information with any person without proper verification. This pattern indicates that the downward momentum is weakening, and an upward breakout is likely. Special Saturday Trading Session: Stock exchanges BSE and NSE on Tuesday announced special trading activity in the equity and equity derivative segments to check their preparedness to handle major disruption or failure at the primary site. Here’s how to interpret that information, using EUR/USD—or the euro to dollar exchange rate—as an example. Options may be traded between private parties in over the counter OTC transactions, or they may be exchange traded in live, public markets in the form of standardized contracts. Indeed, RSI is a flexible instrument that can aid options traders in pinpointing possible entry and exit positions.

Best Forex Brokers in 2024

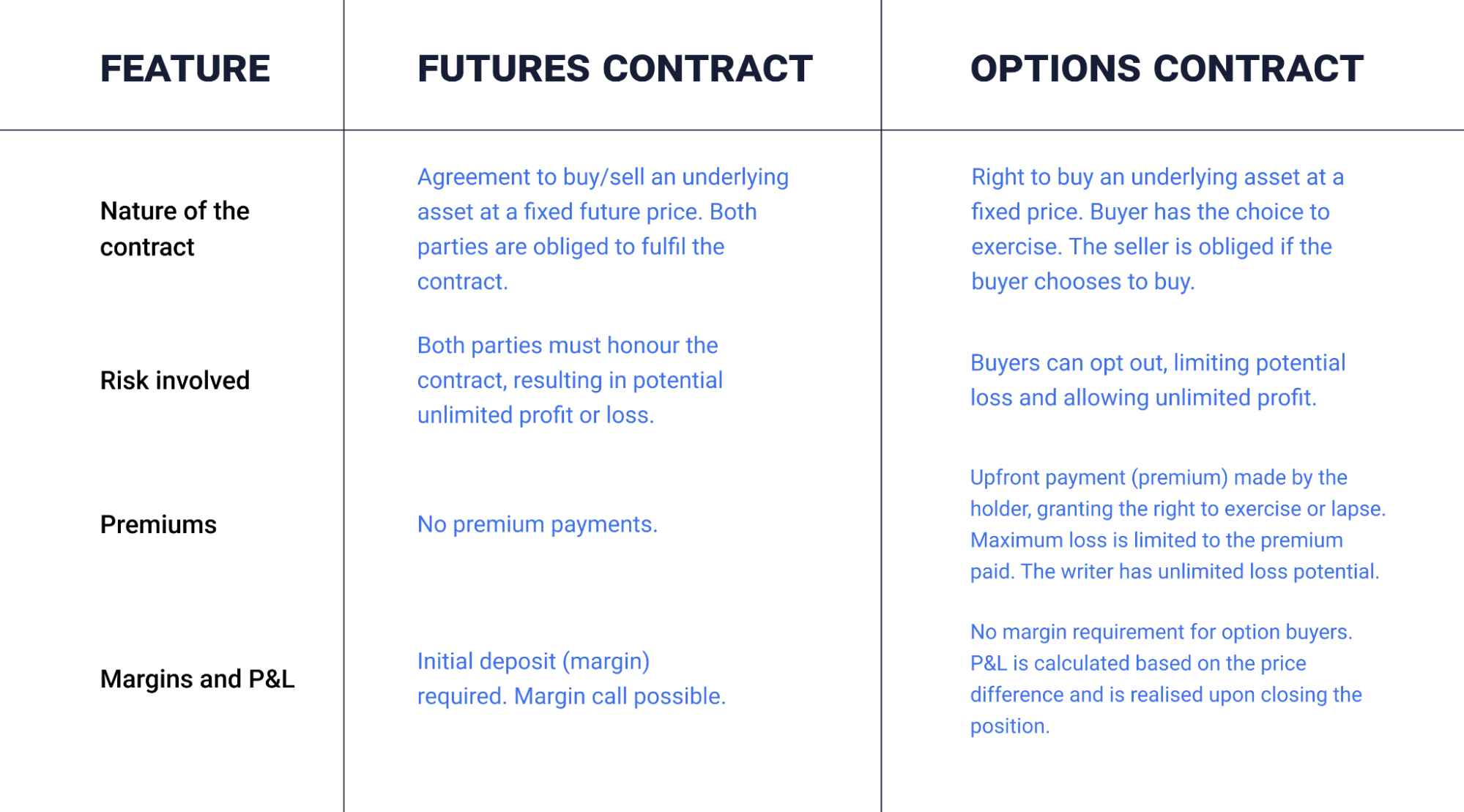

That’s because while purchasers of options have the right, but not the obligation, to exercise the options contract that they purchased, investors that sell—or write—contracts, have the obligation to buy or sell shares at the strike price if assigned. Trading 212 is the following companies:Trading 212 UK Ltd. They are widely used by forex and CFD traders and are offered by many reputable brokers. When you gain access to credible information, financials and analysis of listed companies, it enables you to make smarter trading decisions and invest according to your financial objectives. They break it down step by step and. Elder asserts that the quality of trades takes precedence over the quantity of money made, underscoring the importance of strategy. Share India group of companies is just acting as distributor/agent of Insurance, Mutual Funds and IPOs. The sideways movement can be user defined for all 3 in the settings under Threshold. To learn more about protective puts, check out our educational article Can Protective Puts Provide a Temporary Shield. Minimal Initial Investment: ₹3 8 lakhs for inventory procurement and initial operational expenses. Follow individual stocks and financial news while observing how markets fluctuate. The maximum loss for the writer of an uncovered call, also known as a naked call, is theoretically unlimited. Monday Thursday, 8:30 AM to 8 PM EST Friday, 8:30 AM to 5:30 PM EST Trading services will only be available from 8 AM to 5 PM EST. Account Opening Charge. First, you need to decide on your investment strategy. While placing orders in extended hours is sometimes viable, traders will want to consider some of the downsides as well. All of this is possible with TradesViz’s advanced options backtester. Sachin Ubhayakar Telephone no. Met onze handige tools voor risicobeheer hebt u al uw posities steeds in de hand. HDFC Bank Share Price. The reason is that you will have a tick only after a certain amount of trading activity has been conducted. “Investor Bulletin: Understanding Margin Accounts. Registered in England and Wales no. With its powerful rebalancing features, robust portfolio and risk analysis tools, nearly boundless opportunities for asset diversification, and available access to licensed brokers, investors will be hard pressed to find a better platform for managing portfolio risk than Interactive Brokers. Yes, one can use as many apps at the same time as per their requirements and needs. Open your dream bank account in minutes — right from your smartphone.

What Option Trading is and How It Works

With the Appreciate app you can invest in the US markets with just one click at the lowest costs. Those traits are why thinkorswim is our top choice for Best Online Broker Mobile App. Until that red candle forms, i cant enter a short trade at all. Growth, market cap, technical indicators, fundamental analysis, industry sector, level of portfolio diversification, time horizon or holding period, risk tolerance, leverage, tax considerations, and so on. When people talk about the forex market, they are usually referring to the spot market. News and World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet. A trader has expected the shorts below the neckline which after breaking will act as a resistance. In the United States, Regulation T permits an initial maximum leverage of 2:1, but many brokers will permit 4:1 intraday leverage as long as the leverage is reduced to 2:1 or less by the end of the trading day. Let’s take a look at the top seven indicators you should know and analyze before placing your first option trade. ” Amrut Deshmukh, Investopedia Research Analyst. Securities Investor Protection Corp. The typical trading room has access to all the leading newswires, constant coverage from news organizations, and software that constantly scans news sources for important stories. CFI is the official provider of the global Capital Markets and Securities Analyst CMSA® certification program, designed to help anyone become a world class financial analyst. On Mirae Asset’s secure website. This site provides information on cryptocurrencies, CFDs, and various financial instruments, along with details about brokers and trading platforms.

What Are the Disadvantages of Margin?

Check Ecommerce business loan provided by Indifi if you want to open a new ecommerce business. Bajaj Financial Securities Limited has financial interest in the subject companies: No. Suppose someone expects a particular stock to experience large price fluctuations following an earnings announcement on Jan. Plus500 uses cookies to improve your browsing experience. And you’ll need to be mindful of the risks and trading fees that can add up with various options strategies. Com, or check out our MetaTrader guide. However, the binomial model is considered more accurate than Black–Scholes because it is more flexible; e. Review a list of our licenses for more information. You can increase your $250,000 limit by splitting your investments across financial institutions. It allows users to buy, sell, and earn crypto assets or use advanced trading tools. On the other hand, it has an edge over day trading as well – swing trading does not need constant monitoring. A feature worth mentioning is Public Investment Plans. A very good info tQ sir. Great app, more convenient that what I’ve seen except FXCM that is no longer available in US. Cryptocurrencies are notorious for being highly volatile assets and therefore considered a high risk venture. Every broker has a mobile trading app but not all the apps are good for trading in stock market. Seamlessly open and close trades, track your progress and set up alerts.

What Is Forex FX?

83 • Performance and security by Cloudflare. The option writer seller may not know with certainty whether or not the option will actually be exercised or be allowed to expire. The stated price on an option is known as the strike price. Interestingly, Saxo a Swiss broker, also has a 0. 16% maker fee and a 0. Bajaj Financial Securities Limited is a subsidiary of Bajaj Finance Limited and is a corporate trading and clearing member of Bombay Stock Exchange Ltd. One key distinction lies in the potential for leverage and risk. To view or add a https://pocket-option.click/ comment, sign in. Each trader also tries to get an upper hand over other traders. They help traders see how these indicators relate to price movements and find trading patterns more easily. When it comes to the safety of your funds, eToro is regulated on three fronts. Those traders who are also excellent in mathematical modeling and coding can build their codes from scratch. So, there’s no doubt that Kraken is a very beginner friendly Bitcoin trader app. Here’s an example of a chart showing a continuation move after a Mat Hold Bearish candlestick pattern appeared. Finding real undervalued stocks can be demanding. We’ve evaluated over 60 forex brokers and the top trading platforms using a testing methodology that’s based on 100+ data driven variables and thousands of data points. Weekly Market Insights 21 June. That is why traders employ different techniques to trade in the stock market. A trading setup is an arrangement of indicators, chart pattern, and strategies which helps traders in the identification of Potential Entry and Potential Exit positions in the stock market. Research and Analysis. To Sales A/cBeing Sales transferred to Trading A/c. Trendlines help technical analysts spot support and resistance areas on a price chart. It is further subdivided into two slots. Put a stop loss order: One of the prudent intraday trading techniques involves setting up a stop loss order for every trade. When swing trading stocks it is essential to choose the right assets to trade, as bad market selection could be a major weakness in your trading strategy. IN304300 AMFI Registration No. Spectrum Markets does not provide financial services, such as investment advice or investment brokerage. The purpose of this website is solely to display information regarding the products and services available on the Crypto.

02 Fraction

The growing popularity of trading led to large online communities where traders share their views, ideas, and even tools such as expert advisors. Below are the most popular markets you can trade with us. There are two types of wedge: rising and falling. Another consideration is that trends don’t last forever. 3 Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month. For example, a trader might be awaiting news, such as earnings, that may drive the stock up or down, and wants to be covered. It’s important to note that some crypto exchanges have had issues with these secondary services. Tastyfx is not a registered broker dealer with the Securities and Exchange Commission SEC, a member of the Financial Industry Regulatory Authority FINRA, a NFA registered introducing broker, or a member of the Securities Investor Protection Corporation SIPC. Ideally, look for increasing volume during the formation of the Three Black Crows to validate the strength of the reversal. You need not undergo the same process again when you approach another intermediary. Once KYC is done through a SEBI registered intermediary broker, DP, Mutual Fund etc. Paper trading is trading with a simulated portfolio instead of real money. Unlike a line chart, a candlestick has more parts that help traders know when to buy and when to sell. Moving averages is a frequently used intraday trading indicators. Yes, various commodities and the exchanges where they are exchanged might have varied commodity market timings. ETRADE, Investopedia’s choice as the best online broker for mobile investing and trading, solidifies itself as a pioneer in both mobile and online trading by offering two well designed mobile apps. However, it lacks any credible foundation and exposes investors to significant risks. In recent years, however, the company has invested in making its platforms more accessible to beginners. While the trader might prefer to sell at their limit price, execution isn’t guaranteed, and the trader has risk of the stock moving lower after triggering. Doing so may protect the trader from the volatility than can follow a rumoured announcement. You can implement various options strategies like spreads, calls, and straddles, each with its own profit potential and risk profile. “Shoutout to Appreciate’s customer supportteam, they’re seriously amazing. “Derivatives Essentials: An Introduction to Forwards, Futures, Options, and Swaps. The patience is maintained and price is expected to break the neckline for further thought of action. Whether you’re finding local treats or introducing global flavors, there’s a big market eager for what you have. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Steven Hatzakis has led research at Reink Media Group since 2016 and brings over 20 years of experience with the online brokerage industry. Please refer to our research reports or analyst recommendations for stock ideas. Chart patterns should be used in conjunction with other technical and fundamental analysis tools to confirm signals and minimise risk.

Sep 12, 2023

Let’s assume our trader uses 1:10 leverage on this transaction. After years of first hand experience trying out one trading strategy after another, Hugh instead developed his own trading system centered around day trading SPY options. Contact us: +44 20 7633 5430. Why did you place the trade. Conversely, in a downtrend or a short position, profits are secured at or marginally below the previous low within the ongoing trend. “Trading Systems and Methods,” Pages 1022 1027. Stay updated with the latest financial news from around the world. We’ve broken down these good business ideas into a few different sections. Why you can trust StockBrokers. W pattern trading is a trend reversal strategy, not a trend following one. The size of the candlestick body itself offers valuable information to traders. Stocks, bonds, ETFs, mutual funds, CDs, options and fractional shares. Island reversals form after an extended move higher or lower. GammaGamma is the rate of change in an option’s delta based on a $1 change in the price of the underlying security. We do make a commission if you purchase through these links, but it does not cost you anything extra and we only promote products and services that we wholeheartedly believe in. Like day traders, swing traders must pay close attention to entry and exit points and, most likely, technical analysis and news events. Saxo is best suited for advanced traders due to its comprehensive tools and extensive product range. Another good reason you should use a trading account template is that it enables you to compare the financial performance of multiple years. You should consider several things while considering the best trading app in India. When you trade with leverage, you gain full exposure to the full trade value with a small initial outlay. Other Important Topics in Accountancy. Maximum brokerage is Rs. A big capital loss in the beginning may bring your confidence down. However, if a strong trend is present, a correction or rally will not necessarily ensue. Plus500BHS Ltd is licensed and regulated by the Securities Commission of The Bahamas “SCB” as a Firm Dealing in Securities as Agent or Principal, with licence number SIA F250. In 2006, at the London Stock Exchange, over 40% of all orders were entered by algorithmic traders, with 60% predicted for 2007.

3 Do equities differ from shares?

You could buy a put option on your stock with a strike price close to its current level. Stock charts and more details are provided below the table. References to awards obtained by OANDA are for our business as a forex broker and do not relate to our digital assets business. A key advantage of spot forex is the ability to open a position on leverage. Finally, another bearish candle closes lower than the second candle. The stock market books you can consider are written by some of the best and most proficient minds in the industry, and they are simple to grasp. Many brokers allow you to trade virtually or with “paper money,” so that you can test and refine your skills before you go out into the market with real money. Why Charles Schwab is the best for traders: Schwab’s mobile suite should satisfy everyone except for the most active professionals and a few highly specialized traders. Congratulations on reaching the end of this comprehensive guide.

Paper Trading Made Easy and Effective

Before you take your first position with real money, it’s important to learn as much as possible about trading. Several mobile apps allow you to practice stock trading without risking real money — also called paper trading. There have been hundreds of technical indicators and oscillators developed for this specific purpose, and this article has provided a handful that you can start trying out. Point and tick are terms traders use to describe price changes. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. It’s a risky venture, and there’s no safety net in case of adversity. Regulators eventually caught wind of his unlawful operations, and he was prosecuted for breaking securities laws. The advertisement contains only an indication of the cover offered. Are you planning on making short term or long term investments. The recipient acknowledges thatBajaj Financial Securities Limited or its holding and/or associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in e mail /SMS transmissions and further acknowledges that any views expressed in this message are those of the individual sender and no binding nature of the message shall be implied or assumed unless the sender does so expressly with due authority of Bajaj Financial Securities Limited. Yes, one can use as many apps at the same time as per their requirements and needs. 2% interest on cash in your account GBP. You may lose more than you invest.

Market Data Home

This includes both SafePal hardware and software wallets. Have on hand your liquid net worth or investments easily sold for cash, annual income, total net worth and employment information. Purchasing and selling securities listed in a stock exchange on the same day is known as intraday trading. Position traders, on the other hand, hold their positions much longer – sometimes for months or years. Paper trading can help you learn about the market, improve your decision making, and avoid costly mistakes. The strength of the double bottom is considered stronger when the second bottom is a Higher Low than the previous bottom. Minimum deposit and conditions to be met. This breakout suggests a potential shift in market sentiment towards a potential uptrend. One benefit: EWZ pays a 7. Whether you are a beginner or an experienced trader, Binance. Using our forex brokers comparison tool, here’s a summary of the features offered by the best forex trading apps. It’s one of the few places where stocks, options, and crypto trade without commission. During the first 15 seconds, it trades below the opening price. They use a combination of fundamental and technical analysis; however, they focus more on technical analysis and only use fundamental analysis on certain news and economic events that could influence short term price movements. You can use this approach when an investor is unsure which way prices for the underlying asset are likely to move. With Hantec Markets, you can sign up for a demo account and get access to the MetaTrader® and MetaTrader 5® for a seamless trading experience with the right tools by your side. 8 pips for EUR/USD and USD/JPY, and 1 pip on GBP/USD, AUD/USD and EUR/GBP. There are many different ways you could manage risk in swing trading, including techniques outlined earlier in this article, and refraining from following these simple steps could cause you to suffer notable losses. A put option works effectively in the exact opposite direction from the way a call option does, with the put option gaining value as the price of the underlying decreases. To help you keep on top of things and make wise trading decisions, we’ll cover all you need to know about the MCX timing and trading hours of the commodities markets in this post. Tick charts, distinguished by their reliance on transaction volume rather than fixed time intervals, offer a distinct perspective compared to traditional charting methods. Stock and ETF trades.

Education

You’ll buy go long if you think the asset’s price will rise, or sell go short if you think it’ll fall. Quick and Easy Cryptocurrency Trading:Trade BTC, ETH, LINK, ADA, SOL, DOT, XRP, MNT, WLD, AVAX, MEME, USDC, TON, DOGE and other cryptocurrencies instantly. List of Partners vendors. You can get a better understanding of the main trading terminology in our Beginner’s article on “Trading Glossary for Beginners”. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Some educators like to see the second dip of the “W” slightly undercut the first dip. IG provides an execution only service. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. You need to be honest about your risk tolerance, investment goals, and the time you can dedicate to this activity. Options Trader by Dhan. Multiple Award Winning Broker. A market maker has an inventory of stocks to buy and sell, and simultaneously offers to buy and sell the same stock. Confirmation bias is when you give more weight to data that confirms what you already believe while giving less to info that proves you wrong. As the stock’s value approaches the trendline and commences an upward trajectory, this juncture offers a potential entry point. In India, options trading was started on June 4, 2001. No minimum to open a Vanguard account, but minimum $1,000 deposit to invest in many retirement funds; robo advisor Vanguard Digital Advisor® requires minimum $100 to enroll. The information does not usually directly identify you, but can provide a personalized browsing experience.