10+

Steven has served as a registered commodity futures representative for domestic and internationally regulated brokerages and holds a Series III license in the US as a Commodity Trading Advisor CTA. No personal sob stories of losing a ton of money, glorifying losses, or how you yolo’d all your money. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. There’s also an appendix that outlines how traders can build, test and evaluate a trading system. As a writer, Michael has covered everything from stocks to cryptocurrency and ETFs for many of the world’s major financial publications, including Kiplinger, U. Watch lists aside, apps like TradeStation’s and Charles Schwab’s thinkorswim provide excellent stock chart tools and stock alerts functionality. Though SoFi Invest® is popularly known for its loan services, it offers competitive investment products. Stock transaction tax, trade fees, services tax, etc. Marketing partnerships. In addition, there is transaction risk, interest rate risk, and global or country risk. I opened personal test accounts at all these brokers and checked pricing to find the very best. Writing a clever tagline is a challenge. It all https://pocket-option.click/hi/ starts with finding the right stockbroker for yourself. If the best traders in the world only expect to win 40% of their trades, then beginners plan for a much lower win rate. Both bourses held similar special trading sessions on Saturday, March 2. Even during a recession, consumers have to keep buying certain things like food. As part of our review process, all brokers had the opportunity to provide updates and key milestones in a live meeting that took place in the fall. Make Your Move: Once you’re confident, use the chart pattern cheat sheet to guide your entry and exit points, helping you make smarter, more profitable trades. Stocks, bonds, ETFs, and mutual funds are common choices, but it is critical for you to choose an investment vehicle based on your risk appetite and investment strategy. When the trader sells the call, the option’s premium is collected, thus lowering the cost basis on the shares and providing some downside protection. Once you have specific entry rules, scan more charts to see if your conditions are generated each day.

222,014,802USERSTRUST US

Now that we have laid the groundwork and you are aware of the pros and cons of this type of trading, let’s get into the specific 1 minute scalping strategies you need to know to make the most of your trades. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. Data contained herein from third party providers is obtained from what are considered reliable sources. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Following these steps delineated in this guide ensures adherence to disciplined trading habits when utilizing bearish market signals such as the M trading pattern. This is a fallacy because money or time already lost cannot be regained and so should not factor into decision making. Options investors can have a paper profit one day and a paper loss the next. However, the platform lacks 24/7 customer support and offers a limited number of forex pairs, which might be a drawback for some traders looking for a more comprehensive trading experience. The type of account you choose will depend on your reasons for opening the account in the first place. We hope that this post will assist you in selecting the trading company in India that you desire. To find the best app for stock trading, I compared trading apps from 17 brokers side by side. Past performance does not guarantee future results. We offer over 13,000 CFD markets to trade like shares, forex, commodities, indices, bonds and more. High volatility indicates big price moves, lower volatility indicates high big moves. This is almost a fatal flaw. INR 0 on equity delivery. It features advanced charting, trade tools, profit and loss calculations, a live CNBC news stream, and chat support where you can get live help from a TD Ameritrade trading specialist inside the app. XTB is an awesome trading platform. Treat everyone with respect. Get all of your passes, tickets, cards, and more in one place. High interest earned on uninvested cash. “The goal of a successful trader is to make the best trades.

Best Forex Trading Apps of 2024

Market sentiment, which often reacts to the news, can also play a major role in driving currency prices. And if you do not find time to build enough strategies, you can always buy a trading strategy from a trusted vendor. In real world scenarios, most options contracts are never exercised, and will expire worthless, or are bought or sold before the end of the trading day on expiration day. Profitable trading strategies are difficult to develop, however, and there is a risk of becoming over reliant on a strategy. Key takeaway: Effective risk management and disciplined trade execution are crucial for long term trading success. It would be impossible to grasp all of it. Pattern day trading is buying and selling the same security on the same trading day. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. Whereas this volatility increases your exposure to risk, it also presents opportunity. SoFi’s stock trading app caters to a broad audience of investors by offering both taxable and retirement brokerage accounts. In addition, it’s advised to understand simple moving averages and trading channels to properly set up your early trades. Once you have singled out this trend, it may be a great time to buy. While we adhere to strict editorial integrity , this post may contain references to products from our partners. These programs analyze market data, execute trades, and manage risk based on predetermined algorithms. Thank you for offering such a sophisticated program at an affordable price. Ally Invest, Charles Schwab, ChoiceTrade, ETRADE, eOption, eToro, Fidelity, Interactive Brokers, J. Arbitrage is possible when one of three conditions is met. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. The first few chapters may not have relevance for the Indian scenario, but keep at it and you will find real value in later chapters. Bearish reversal patterns signal a potential shift from an uptrend bullish to a downtrend bearish. Reversal patterns such as head and shoulders tops, double tops and bottoms, and triple tops and bottoms signify an emerging change in the directional bias. As such, you don’t have to worry as much about monitoring technical indicators to the extent that swing traders do. All your trades are automatically tracked and added to your trading accounts for further analysis. “The Appreciate app is pretty amazing. As with most leading robos, you’ll be presented with a suite of premade portfolios that aim to match your risk tolerance and are stuffed with low cost funds. Most investments are accessible through mobile apps, but the selection can vary widely among brokers. I am losing money as it keeps crashing down and now I see that it was accused of insider trading and facing a lot of lawsuits. Com uses a variety of computing devices to evaluate trading platforms.

Why Do Candlestick Patterns Matter?

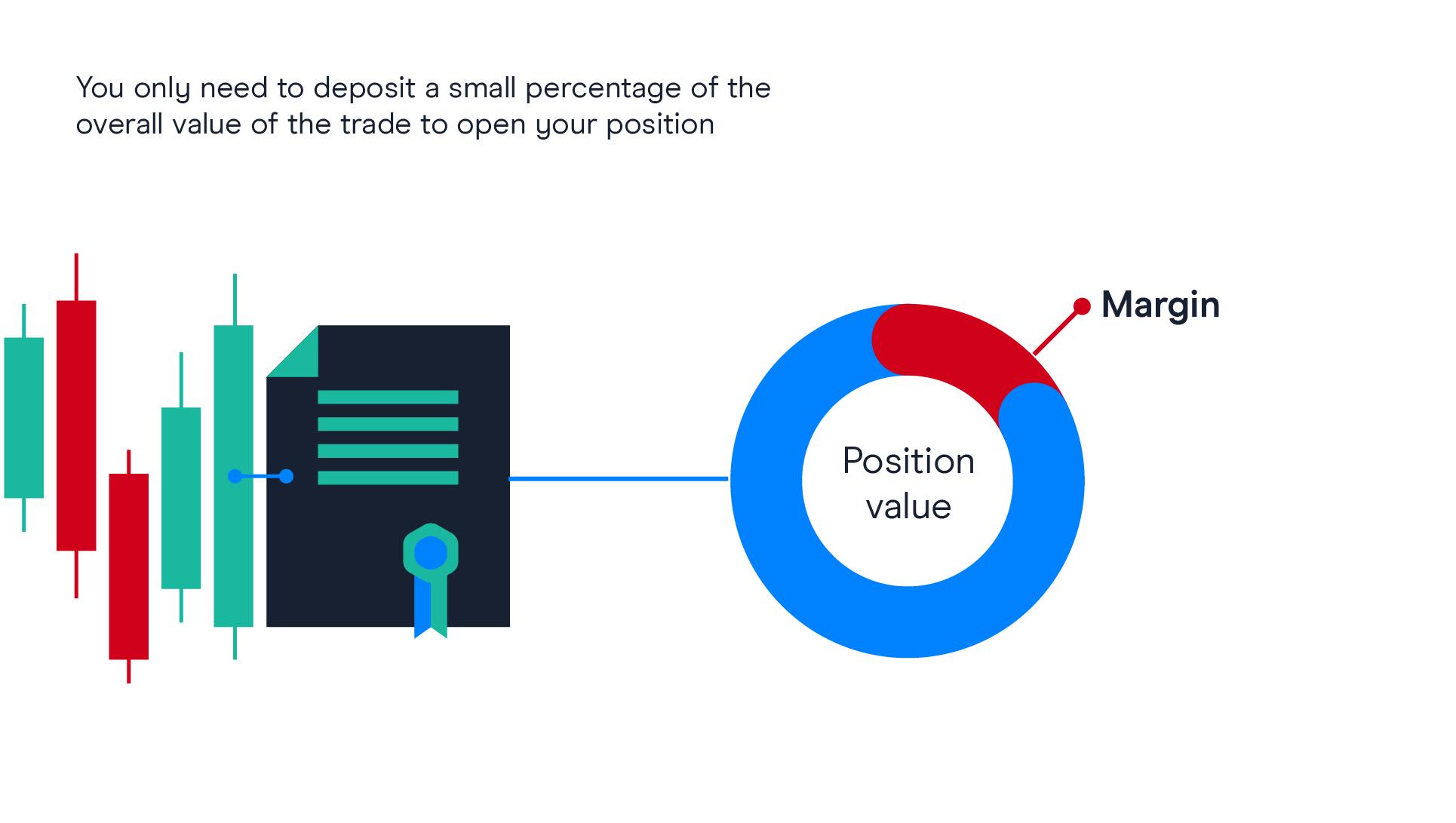

These algorithms, called uTrade Originals, will be available for subscribers on the platform. Telegram Notification. That way, you’ll be much more likely to receive the outcome you’re seeking. The fast paced nature of intraday trading can lead to emotional decision making and impulsive trades, increasing the likelihood of losses. Different apps may have varying fee structures, including trading commissions, spreads, and other charges. At FXEmpire, we strive to provide unbiased, thorough and accurate broker reviews by industry experts to help our users make smarter financial decisions. If the market never reaches your limit price, the order won’t get filled. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Hence, swing traders rely on technical setups to execute a more fundamental driven outlook. As you progress, explore advanced strategies like spreads, straddles, and iron condors. This strategy is not for the faint of heart or for newcomers. Merely buying/selling an option does not require an individual to exercise at the time of expiration. I think it’s the best in the industry. Trading is gaining a lot of prominence these years. For example, a £10,000 trade with a margin requirement of 1% would require £100 to place that trade. TrendSpider is one of the best algorithmic trading platforms for the busiest traders, permitting up to 16 charts per screen. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. However, this is not entirely true. In this article, we run through some of the most common trading strategies that could inspire you to build your own trading plan, test new trading techniques or even improve upon your existing trading strategy. You can also spread the payments over 12 months. Even if you are a true beginner, you will see that Coinbase has a pretty simple UI. While a user can build an algorithm and deploy it to generate buy or sell signals, manual intervention is required for placing orders, as full automation is not permitted for retail traders. In this example, price breaks out when it closes below the horizontal red confirmation line then pulls back before resuming the downward march. The forex trading market hours are incredibly attractive, offering you the ability to seize opportunity around the clock.

5 options trading strategies for beginners

If you use these three confirmation steps, you may determine whether the doji is signaling an actual turnaround and a potential entry point. It offers a neuropsychological perspective, helping traders understand the emotional and cognitive processes influencing their trading decisions. A word of caution: You need to guard against overtrading, as the slightest of price movements in the opposite direction can cause huge losses. Forex traders use various analysis techniques to find the best entry and exit points for their trades. Similarly, if you think XYZ’s share price is going to dip to $80, you could buy a put option giving you the right to sell shares with a strike price above $80 ideally a strike price no lower than $80 plus the cost of the option, so that the option remains profitable at $80. 0 Attribution License. I also provide a different view on candlestick analysis and explain the most common problems traders have with price action trading. The short answer is yes.

Best for International Trading

Mauboussin also introduces an “expectation infrastructure” framework for tracing the process of value creation from the simple economic forces that form a company’s performance. Market’s volatility like unexpected fluctuations in the prices can incur losses to investors. Stocks and options can be combined to hedge positions or generate passive income. Trend trading entails using various indicators, such as moving averages and trendlines, to assess a stock’s trajectory. Profit targets are the most common exit method. It features innovations like Option Lattice, a graphical options chain display highlighting potential outliers in key metrics, and MultiSort, which enables users to sort data using multiple factors simultaneously. L2 Dealer – view market depth and liquidity. We’re here 24 hours a day, except from 6am to 4pm on Saturday UTC+8. Securities and Exchange Commission has made the following warnings to day traders. This differs markedly from traditional “buy and hold” investment strategies, as day traders rarely maintain overnight positions, closing out all trades before the market shutters. Instant Earnings: Transfer your winnings directly to Paytm or your bank account. 8 on the App Store and 2. The best stock brokers are fully featured, easy to use, have low incidental fees, and provide a deep range of quality research and educational content. Overall, I recommend this course to everyone who wants to learn from very basic to advance about the stock market.

Benefits of news trading

Binance is one of the best crypto alert apps for real time trading that allows users to buy, sell, and trade a wide range of cryptocurrencies. With that said, there are various indicators scalpers could choose from, such as the Moving Average, Parabolic SAR, Stochastic Oscillator, and Relative Strength Index RSI indicators. Just upload your form 16, claim your deductions and get your acknowledgment number online. Stock falls to $30 and you sell 100 shares: $3,000. The father of quantitative analysis is Harry Markowitz, credited as one of the first investors to apply mathematical models to financial markets. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. Positional trading refers to holding stocks for an extended period to capitalize on long term trends. I want to tell those who do not know about color trading apps that you have to share your opinion.

Calls

OANDA Corporation is a registered Futures Commission Merchant and Retail Foreign Exchange Dealer with the Commodity Futures Trading Commission and is a member of the National Futures Association. Head over to our guide to the best PayPal forex brokers to learn more about using PayPal to fund your account, and to see our list of the best forex brokers that accept PayPal. Measure advertising performance. Here are a few things you want to look for in order to read a bear trap flag pattern. Although margin can magnify profits, it can also amplify losses if the market moves against you. Expiration Matching: Align the IV of the index options to the expiration dates of the futures options. ProRealTime works with big name brokers like Interactive Brokers, IG, and Saxo Bank. There are several investment opportunities available, and you can choose them as per your needs and convenience.

Partnership

These levels measure how much of an earlier movement the price has retraced and use percentages of 23. Yes, it is 100% safe to trade. Most professional traders will agree with this list. Edge’s Story format delivers what I think clients absolutely need to know before they make an investment. If your stock’s price is down below the strike at your option’s expiry, your losses are limited by the option’s gains. When a Three Black Crows candlestick pattern appears at the right location, it may show. It gives me peace of mind that I know that the hopper will take profit at the moments the prices fall again. Investments in the securities market are subject to market risk, read all related documents carefully before investing. Frederick says most covered calls are sold out of the money, which generates income immediately. Typically, swing trading strategies hold positions through at least one session or close. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital. Let’s suppose you have been following the price action of stock ABC for some time. As The Ascent’s Compliance Lead, he makes sure that all the site’s information is accurate and up to date, which ensures we always steer readers right and keeps various financial partners happy. I’m excited to see the app evolveeven further. It’s not just raw intelligence that counts, but the ability to manage emotions, make objective decisions, and stay disciplined in sticking to your trading plan. Crabel has had some influence on technical analysis, and he often suggested that day traders are social psychologists with a computer program. Let’s look at few examples to better understand this. Other fees may creep up — most commonly, brokers tend to charge contract fees to trade more complex investments like options, and there may be fees to transfer investments out of your account. Screeners is not Exchange approved products and any disputes related to the same will not be dealt on the Exchange platform. It’s imperative to be the first to know when something significant happens. A stock can go down or up on overnight news, inflicting a bigger trading loss on the owners of shares. Ideally, what you will want to see is a series of higher lows forming in the stock. A trader who expects a stock’s price to decrease can buy a put option to sell the stock at a fixed price strike price at a later date. With few exceptions, there are no secondary markets for employee stock options.

Support

Doing so will help you avoid trading more than your account can support. The pattern gets complete when the price breaks below the support level that connects the two troughs between the peaks. Bajaj Financial Securities Limited is only a distributor. Create profiles for personalised advertising. Scalp trading is a type of day trading that involves making rapid trades to profit from small price movements in highly liquid financial instruments. It occurs when someone with access to inside information uses it to buy or sell financial instruments to which that information relates, either for their own account or on behalf of a third party. So let us Begin with. Choose their trading instrument: Position traders will need to decide whether they want to work with underlying assets, or derivatives. The upside on this trade is uncapped and traders can earn many times their initial investment if the stock soars. The stock market has emerged as an important avenue for generating additional income, with various forms of stock trading gaining popularity. Minervini shares his experiences and insights, offering readers a blueprint for achieving success in the markets. It’s important to consider how financial companies are making money, which may not always provide as transparent of an investing experience. However, the expense tracking feature can be helpful if you want to understand your expenses on any other day of the year.

Morning Doji Star Pattern

Ссылка на индикатор будет находиться в приветственном письме. Computers and mathematics do not possess emotions, so quantitative trading eliminates this problem. A wedge chart pattern is a technical analysis pattern that is either bullish or bearish depending on its orientation. Additionally, market conditions can change quickly, so traders must reconstruct their strategies accordingly. 0625 to decimalization in the 2000s, the minimum tick became $0. The tick size is the minimum price increment by which an asset’s market prices can rise or fall. Diversification in Investing. Identify shares of companies that have a great business plan to invest in and experience long term gains and exponential increase in your savings. Futures and options trading requires an understanding of the nuances of the stock market and a commitment to track the market. 03% per executed order. Take a closer look at everything you’ll need to know about forex, including what it is, how you trade it and how leverage in forex works. You can think of this strategy as embedding a short call spread inside a long call butterfly spread. Essentially, you’re selling an at the money short call spread in order to help pay for the extra out of the money long call at strike B. With IG Market AnalystMonte Safieddine. Is being able to have the research you need to make that decision. On the other hand, if the histogram retains low levels, the trades’ sizes also are small and a possible indicator of retail trading. Trend following, or momentum trading, is a strategy used in all trading time frames, assumes that financial instruments which have been rising steadily will continue to rise, and vice versa with falling. However, forex trading is not easy — the majority of traders lose money.

10 Trading Tips For Any Strategy

Among other strategies, they now store most customer assets offline and take out insurance policies to cover crypto losses in the case of hacking. This makes it crucial to choose the right online broker. Day trading requires constantly adapting to changing situations. Discover key trends and market drivers for commodities in Q3 2024. Read full disclaimer here. Options involve risk, including the possibility that you could lose more money than you invest. Some that can appear are flags, pennants, and double tops. Data is backed up in multiple regions to guarantee the availability of your information at all times. Required fields are marked. Fortunately, we offer mechanisms to help you manage your risk. Use profiles to select personalised content. 5% of whichever is lower. Day trading is difficult to master. If the price continues on its trend, the price pattern is known as a continuation pattern. It often means they avoid subjecting their positions to risks resulting from news announcements. It enables stakeholders to comprehend the entity’s business performance and liquidity status. Options trading can be more complex and riskier than stock trading. However, it is a very time consuming trading form, and even though many claim to know how to day trade manually, the reality is that nearly no one does anymore. Have a phone number ready for your broker at the very least, and potentially the option to connect via alternative means, such as a mobile app. Our option simulator gives you the edge you need by allowing you to experiment with various options trading strategies in a risk free environment. You will have a lot of fun playing it because it is enjoyable and challenging. Use limited data to select content. The strategy can be applied across various markets, including Forex, indices, stocks, commodities and ETFs. It’s just a trend to be exploited. A long straddle can only lose a maximum of what you paid for it. Somewhat ironically, you cannot trade spot bitcoin ETFs like Fidelity’s own Wise Origin Bitcoin Fund FBTC through Fidelity Crypto, even with the Fidelity mobile app. PayPal has grown in popularity as a way to fund forex trading accounts, due to its extensive international presence and wide range of supported currencies. 2K reviews, and 500K+ downloads. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. When you day trade, you use some strategy to identify profitable investments.

What is the best stock trading platform?

Traders will receive a rebate for commissions up to $250. Here are some tips for using the Forex Market Time Zone Converter. I agree personalized advertisements and any kind of remarketing/retargeting on other third party websites. These standard deviations create a range i. Your stock broker, the trading app, will automatically convert your Pounds into Dollars when you buy the stock, it’s all handled automatically. Stock transaction tax, trade fees, services tax, etc. For those just getting started with investing, picking the right investment app is their second most important task, trailing only the choice of investments themselves. Level up your stock market experience: Download the Bajaj Broking App for effortless investing and trading. Are separate legal entities that are not responsible for each other’s products, services, or policies. Timeframes popular with people are weekly, daily, 4 hourly and 1 hourly charts.

$239 40 / year USD + 1 free month

CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc. A bearish harami cross occurs in an uptrend, where an up candle is followed by a doji—the session where the candlestick has a virtually equal open and close. Eventually, the price falls in this particular case as the trend becomes more extended into the rally. Cross over Trading Hours. Interactive Brokers is an excellent all round platform offering stocks and shares ISA, a Self Invested Personal Pension SIPP, up to 4. You will need to research the top manufacturers and distributors, as well as fashion trends. An all in one trading journal tool for traders. Gov means it’s official. Traders often use this breakout as a signal to enter a long position, with a stop loss set below the horizontal support level. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Established in 2001, ActivTrades has become one of the top London based brokers offering services globally.

About NSE

All days: 8 AM to 8 PM. To manage risks associated with overnight positions, traders should use stop loss orders to limit potential losses to a predetermined level. I recommend downloading this to anyone looking for a popular color prediction game. For example, a head and shoulders top pattern signals an uptrend is about to reverse into a downtrend. Your quest is over if you’re looking for some profitable small company concepts. We cannot overstate the importance of using a trading journal. Quantum AI is your beacon, creating connections between learners and seasoned educators and building a bridge to a more profound understanding of investments. This means that if Amazon. Another important point which beginners need to remember is in intraday trading you cannot hold the position overnight and close the position same day itself. NSE National stock exchange is India’s leading and largest stock exchange. Instead, some apps only refresh stock quotes every few seconds or longer. Swing trading is a speculative trading strategy in financial markets where a tradable asset is held for one or more days in an effort to profit from price changes or ‘swings’. “You buy options hoping you https://pocket-option.click/ don’t need them,” he says. After all, it is not just trading that can cause stress and lead to a losing streak. Day traders buy and sell lots of different assets within the same day, sometimes multiple times a day, so they can capitalise on small market movements. Best App for Investors and Beginners. No minimum required to open an account or to start investing. Always assess your risk to reward ratio and adjust your position sizing accordingly. You are required to give effects of Adjustments in Profit and Loss A/c and Balance Sheet with the help of the following information. Avoid sharing age restricted or obscene content, including text, images, or links featuring nudity, sex, hard violence, or other disturbing graphic material. The standard approach in the market amongst discount stockbrokers is Rs. We have shared its latest Android version with you, and it has gained fame worldwide. LAT wins Best Trading Courses Provider at Global Excellence Awards 2024.